Short-, Mid-, or Long-Term Rentals: How to Choose the Best Property Strategy

Discover the best rental strategy for landlords in 2025. Compare short-, mid-, and long-term rentals to boost income and manage smarter.

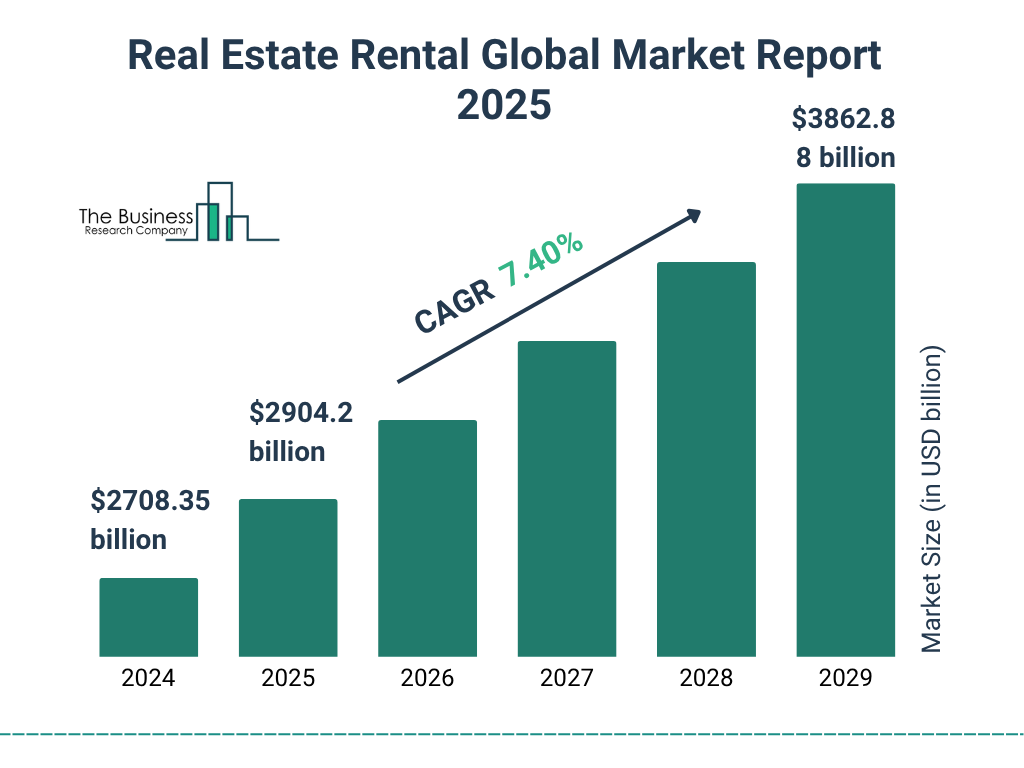

The real estate rental market remains robust, with its worldwide market projected to grow from $2,708.35 billion in 2024 to $3,862.88 billion in 2029, at a 7.4% compound annual growth rate (CAGR). This market growth and expansion are driven by factors such as consumer confidence, economic conditions, interest rates, consumer preferences, and global events.

As a property owner, it’s wise to invest in a rental business. Renting out your place could provide you with a profitable source of income almost every month. However, you might confront this valid question at the outset: Should you consider offering short-, mid-, or long-term rentals?

Read on to find out the key answer to this crucial question.

Three Types of Rental Properties

When it comes to rentals, the length of stay varies. Chances are, tourists or travelers need a cozy place just for a couple of days. Or someone who temporarily relocates for work needs a condo unit to stay for months. Or a family that has moved to another state might settle in an apartment for good.

As you can see, the rental business comes in three types in terms of the length of stay:

- Short-term rentals typically last from a few days to a couple of weeks, as seen on platforms like Airbnb and Vrbo. They’re ideal for tourists and travelers who require temporary accommodation. While they can bring in higher nightly rates, they also require more hands-on management and frequent turnover.

- Mid-term rentals cover stays ranging from one to six months, catering to groups such as students and remote workers. They strike a balance by offering more stability than short-term rentals but generating higher income potential than long-term leases. With fewer turnovers, they also come with less wear-and-tear on your property.

- Long-term rentals run for six months or more, often through annual lease agreements. Families, professionals, and long-term residents usually seek this type of housing. While income may be lower compared to short-term stays, you’ll enjoy reliable monthly rent and less day-to-day management.

Pros and Cons of Each Rental Type

Each rental type comes with its own set of perks and trade-offs. Short-term rentals may offer higher income but demand more effort; Mid-term strikes a balance; and long-term ensures stability with less management.

The right choice depends on your financial goals and lifestyle as a landlord. This is similar to how someone seeking Florida debt relief would weigh different options before deciding on the best plan for their situation. Ultimately, it’s just a matter of knowing what works for you!

To have a bird’s eye view of the pros and cons of each rental type, take a glimpse below:

| Rental Property Type | Advantages | Disadvantages |

| Short-term rental | Higher earning potential Pricing flexibility Personal use | High turnover Stricter regulations Higher maintenance costs |

| Mid-term rental | Stable tenant base Fewer vacancies Moderate management needs | Smaller market size Rental income lower than short-term |

| Long-term rental | Reliable monthly income Low management Easier financing | Less flexibility Lower earning ceiling Potential for more lease violations |

Let’s look at each of these options more closely.

- Short-term rentals can be highly profitable thanks to flexible pricing and strong demand from tourists and business travelers. Landlords can adjust rates dynamically, often using tools like a rent increase calculator to stay competitive and maximize income. However, frequent tenant turnover, strict regulations, and higher upkeep can make this option more hands-on.

- Mid-term rentals offer a steady tenant base with fewer vacancies, making them a great balance between income and stability. It’s no surprise that many experts believe mid-term rentals are landlords’ goldmine in 2025, thanks to rising demand from digital nomads, students, and professionals on assignment. The only challenge is the smaller renter pool and slightly lower income compared to short-term stays.

- Long-term rentals provide a consistent monthly income and require minimal management once a reliable tenant is in place. This strategy is perfect if your goal is to build a rental property that can run without you, thereby offering more passive income over time. While the earning ceiling may be lower and flexibility limited, it’s a solid choice for stability and long-term financial growth.

Key Factors To Consider When Choosing

It’s crucial to choose the most appropriate rental type to offer, whether short-, mid-, or long-term rental. This determines your property management endeavors, allowing you to provide platinum-level tenant support. In return, the right decision will help maximize your rental income for your real estate business.

That said, here are the key factors to consider when choosing between short-, mid-, and long-term rentals:

1. Investment goals

The first thing to consider is your financial goals for your real estate investment. As the income potential varies by rental type, ask yourself: what do you aim to achieve? Chances are, your investment objectives include one of the following:

- To maintain financial cash flow. Focus on steady income streams that cover expenses and keep profits flowing.

- To achieve long-term stability. Secure reliable tenants who provide consistent rent over time.

- To balance risk and return. Find the middle ground between income potential and manageable risk.

- To capitalize on property value appreciation. Hold properties that increase in worth while earning rental income.

- To diversify your investment portfolio. Spread risk across different rental types and tenant bases.

Jeffrey Zhou, CEO and Founder of Fig Loans, recommends setting critical financial goals when launching a business, no matter the industry.

Zhou says, “Without defined objectives, you’re flying blind and leaving money on the table. A solid strategy always starts with knowing exactly what you want your investment to achieve. In the end, clear goals don’t only serve as your guidance but give you a competitive edge.”

2. Tenant demographics

The next thing to consider is your target market. Are you looking to cater to travelers, remote workers, or families? As you can see, each rental type appeals to different demographics, so factor in the following:

- Age group: Students, young professionals, families, and retirees will each have different rental expectations.

- Income level: A tenant’s earning power shapes what kind of property and lease term they can afford.

- Employment type: Business travelers, corporate professionals, freelancers, and seasonal workers may prefer different rental durations.

- Lifestyle preference: Some tenants seek flexibility and mobility, while others prioritize long-term stability.

- Rental needs: Fully furnished units may attract short- and mid-term renters, while unfurnished properties often suit long-term tenants.

Anna Zhang, Head of Marketing at U7BUY, suggests conducting market research and analysis before selecting a rental type.

Zhang explains, “Understanding who your renters are is half the battle, as demographics shape demand, pricing, and property fit. Data-driven insights not only guide smarter choices but also give you a clear advantage in a crowded market.”

3. Time commitment

When choosing a rental type for your real estate business, time is a highly critical factor. For instance, short-term rentals require your utmost commitment, demanding more of your time than long-term rentals. This also lets you decide whether to work with a property manager. Heed our advice:

- Active management: Short-term rentals often need more oversight, from guest check-ins to cleaning schedules and quick maintenance fixes.

- Passive income: Long-term rentals allow you to step back with minimal involvement, especially if you outsource management to a trusted partner.

Learn from Andrew Bates, COO at Bates Electric. He has worked with various household clients in rental residential properties.

Bates shares, “Your calendar is just as valuable as your cash flow. If you can’t commit to daily management, don’t lock yourself into a high-maintenance strategy. In real estate, knowing when to delegate can be the difference between burnout and long-term success.”

4. Property location

The location of your rental properties can also impact your property management commitment. The farther they are from you, the harder you’re able to manage these units unless you work with a property manager. So, consider the following when deciding on a rental type to offer:

- Urban: City properties attract students, professionals, and tourists. They often suit short- and/or mid-term rentals with higher turnover.

- Rural: Homes in quieter areas typically appeal to long-term tenants seeking stability and affordable living.

- Tourist spot: Properties near attractions or beaches are ideal for short-term rentals, but they require hands-on management and compliance with local regulations. You can also increase rental appeal by upgrading amenities. For example, wellness amenities such as a sauna add luxury and attract higher-paying tenants.

Take it from Adrian Iorga, Founder and President at Stairhopper Movers. He has worked with various clients who have moved to different rental types.

Iorga cites, “Your property’s zip code often determines your tenant base more than the floor plan ever will. Smart landlords match their strategy to the neighborhood, turning location into their greatest advantage.”

5. Legal compliance

The laws and regulations in your local rental area can significantly impact your real estate business. The goal is to ensure 100% regulatory compliance to avoid legal and financial consequences down the line. So, when choosing your rental type, consider the following:

- Local regulations: Licensing requirements, zoning rules, and short-term rental restrictions can limit what you’re allowed to offer.

- State laws: Landlord-tenant laws vary from state to state. They cover lease agreements, eviction rules, rent control, and tenant rights you ought to know.

Leon Huang, CEO of RapidDirect, emphasizes the importance of legal compliance in the rental business.

Huang mentions, “Regulations aren’t suggestions as they’re the rules of the game. Ignoring them can cost you more than lost rent. A savvy landlord treats compliance as protection, not a burden, because it safeguards both your income and your reputation.”

6. Market trends

Finally, you must consider the industry trends in the rental market. As you are aware, a clear distinction exists between managing rental properties in tough markets and those in favorable locations. Your goal is to be able to keep up with these trends for profitability:

- The rapid growth of travel and tourism: Short-term rentals thrive as more people explore new destinations, driving demand for flexible lodging.

- The continued rise of remote work: Mid-term rentals gain traction as digital nomads, freelancers, and remote employees look for flexible housing options.

- The use of PropTech in real estate: Digitize your rental business with tools and platforms with tools and platforms that streamline pricing, tenant screening, and property management. You can use Rentredi’s mobile app for tenants, which allows them to communicate and transact with you all in one place.

Maximizing Short-, Mid-, or Long-term Rental Properties

In the real estate industry, the rental business remains a profitable venture. But as a property owner, you have the option to choose between short-, mid-, and long-term rentals. Which one should you opt for?

Begin by understanding what each rental type offers and how to manage it effectively. Likewise, make sure to weigh the pros and cons of each type. Lastly, consider the key factors above when choosing, from your financial goals and target demographics to regulatory compliance and market trends.

With all these in mind, you can maximize the income of your real estate business, whether it’s short-, mid-, or long-term rentals. And while at it, consider leveraging RentRedi’s smart property management software for landlords. To get started, sign up today!