Screen Smarter, Rent Better

RentRedi partners with TransUnion and Plaid to give you full credit, criminal, and eviction checks, plus verified income reporting— all FCRA-compliant, transparent for everyone.

How RentRedi Helps You Find the Best Tenants

Our partnerships with TransUnion and Plaid provide you with customized reports for every tenant you screen.

Credit Reports

TransUnion’s ResidentScore predicts rental eviction risk 15% better than traditional credit scores.

Criminal Reports

Search 370M+ records nationwide for peace of mind.

Eviction Records

National coverage of databases with 27M eviction records.

Income Verification

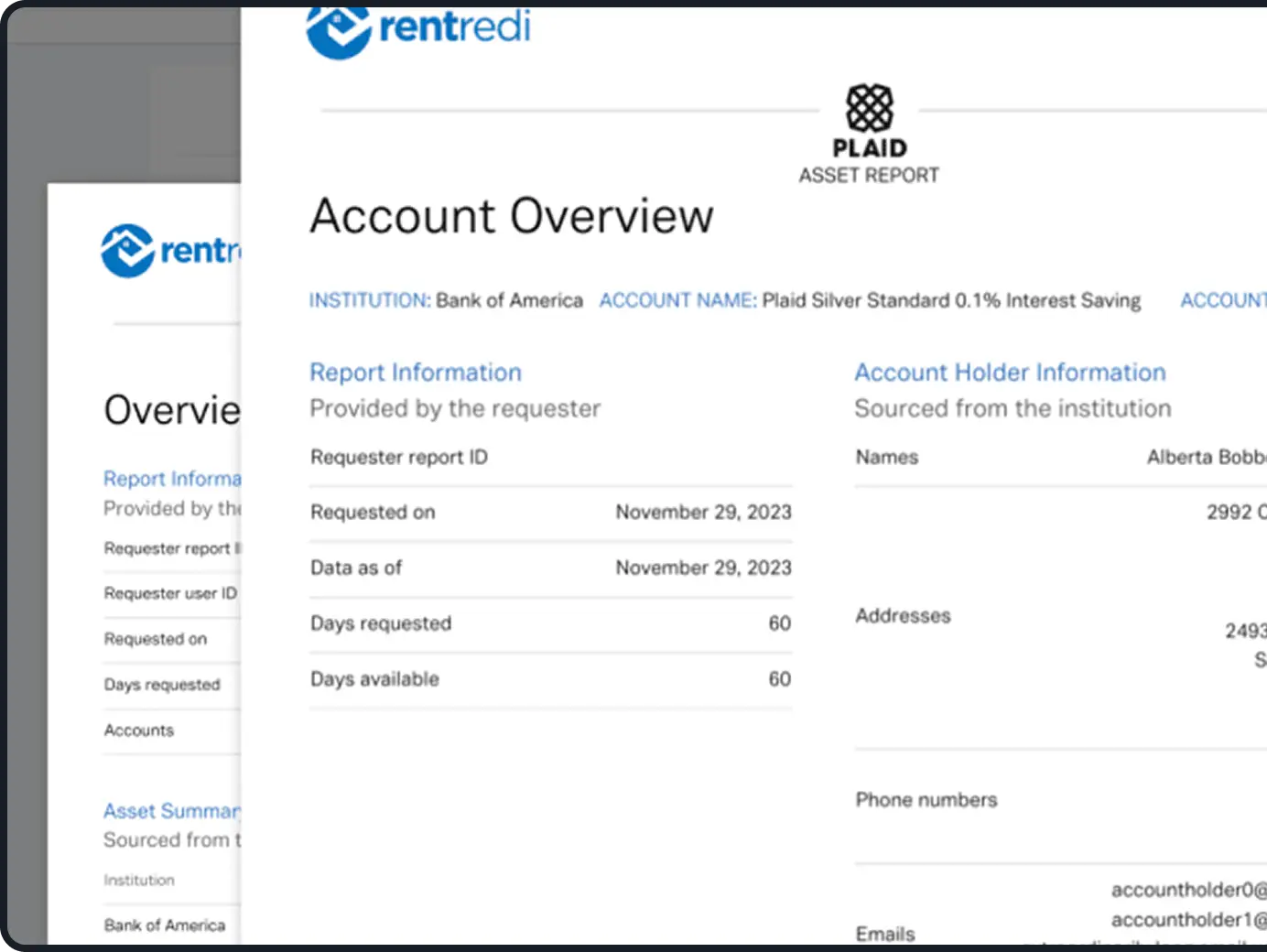

Plaid-certified income summary, total earnings by month, and assets verification.

Frequently asked questions

Everything you need to know about the product and billing.

How does RentRedi tenant screening work?

RentRedi partners with TransUnion to deliver trusted background reports, including credit, criminal, and eviction history. Landlords can automatically initiate a screening request from their dashboard, and tenants complete the background report on their RentRedi app.

How much does tenant screening cost on RentRedi?

Screening costs $49.99 per applicant, paid directly by the tenant. This includes a full background report from TransUnion (credit, criminal, and eviction histories) and a verified tenant income report certified by Plaid. There are no subscriptions or hidden fees.

What does a RentRedi tenant background check include?

Each report includes a credit report, criminal background check, and nationwide eviction search, all pulled directly from TransUnion’s verified databases. You can also add income and employment verification from Plaid.

How long does a RentRedi background check take?

Screening results are usually available instantly after a tenant completes their application and identity verification. You’ll receive an automatic notification when the report is ready to view.

Can landlords automate or require screening for all applications?

Yes! You can choose to automatically request screenings for every new rental application — saving time and ensuring consistent screening practices across all units.

Does RentRedi screening affect the tenant’s credit score?

No. RentRedi screenings use a soft inquiry, meaning it doesn’t impact the applicant’s credit score. This allows landlords to screen responsibly while protecting tenants’ credit health.