Use On-Time Rent Payments To Boost Your Credit Score Up To 26 Points!

When you pay rent through the RentRedi mobile app, you can report all on-time rent payments to TransUnion, Experian, and Equifax to boost your credit score. 60% of renters even see improvements after 1 month!

Download the RentRedi tenant app to get started.

Why Is Increasing Your Credit Score Important?

53% of renters want better credit to purchase a house. With a credit boost from TransUnion, Experian, and Equifax, renters are one step closer to achieving the goal of homeownership.

- Access lower interest rates for car loans, home loans & other loan types

- Waive or reduce deposits to open utility or cell phone accounts

- Increase your credit limits

- Be a more attractive tenant

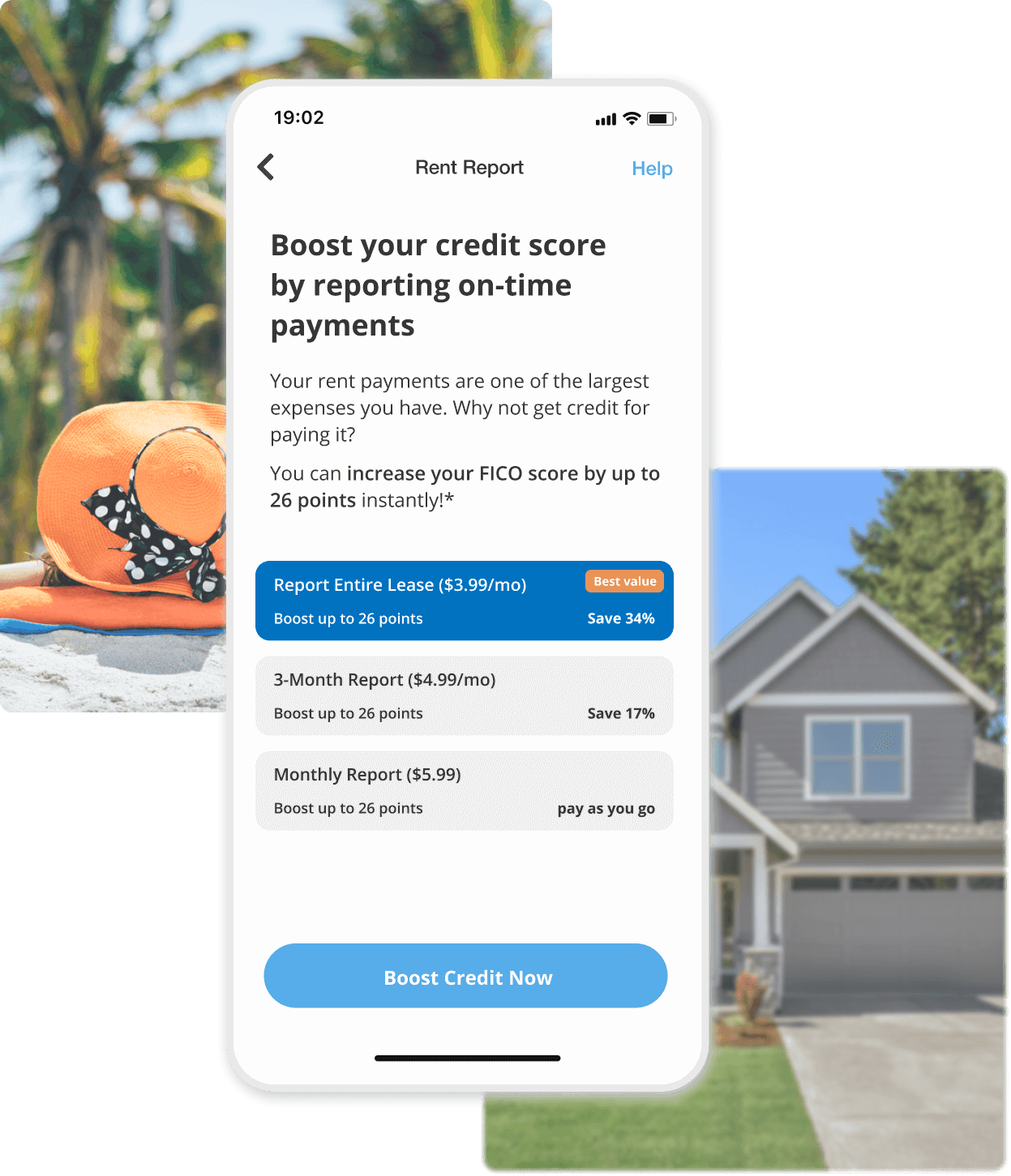

Select Your Plan

Choose if you would like to create Monthly, Entire Lease, or 3-Month Rent Report.

Monthly

pay as you go

$599/mo

Entire Lease

save 34%

$3.99/mo

*required if lease ends within 6 months

3-Month

save 17%

$4.99/mo

Why You Should Report Rent Payments

Increase your credit score by reporting payments you’re already making

Alternative method to build credit besides using credit card

Helps repair bad credit every month

FAQ

Which credit bureaus are my on-time rent payments reported to?

We report your on-time rent payments to TransUnion, Experian, and Equifax. TransUnion is the same company that does credit & background screening for new tenants on RentRedi. They use the information to increase your FICO credit score. You can learn more about the TransUnion’s ResidentCredit program here. https://www.transunion.com/product/residentcredit

Why should I report my on-time rent payments to TransUnion, Experian, and Equifax?

Typically, credit bureaus use credit cards and loan payments (such as student or home loans) to assess credit scores.

However, with RentRedi, you can now report your on-time rent payments to credit bureaus as well!

With rent being a large monthly payment, you can increase your credit score with rent payments you are already making!

Additionally, a high credit score can mean access to lower interest rates for car, home & other loans, waived or reduced deposits to open utility or cell phone accounts, increased credit limits, and overall positions you as a more attractive tenant.

How soon will I see a boost in my credit score?

Payments are reported to the credit bureau every week. Once your rent is reported to TransUnion, it typically takes 5-30 days to show on your credit history!

How do I start reporting rent?

From the RentRedi Tenant app, select “Rent”, then “Report Rent” and then follow the options provided to you.

What is the cost to report my rent payments to TransUnion, Experian, and Equifax?

For current tenants, there are 3 options. Regardless of the option you select, TransUnion recommends reporting 12 months of payments to make the most impact on your FICO credit score.

**Note: Experian only records the current month and prior rent payment history will not be reported by Experian.

Entire Lease

You can report on-time payments for your entire lease at once. This includes all future payments & the option to add all past payments made through RentRedi for the price of $3.99/mos.

The cost for reporting an entire lease at once can be up to a one-time payment of up to $47.88 (for reporting 12 months) to increase your credit score by up to 26 points.

3-Months

You can choose to report your on-time payments every 3-months, costing $4.99/mos. The cost for reporting 3 months of rent payments costs $14.97.

Monthly

The most flexible option is that you can choose to report your on-time payments every month. This pay-as-you-go option costs a recurring $5.99/mos.

How do I turn off/remove reporting my rent payments to TransUnion, Experian, and Equifax?

If you want to stop reporting rent payments, contact us at [email protected].

Can I build my credit history with RentRedi?

Yes! When you start reporting rent to the TransUnion, Experian, and Equifax, you choose to use all on-time rent payments you’ve made through RentRedi to help build your credit score.

You will be able to report all your rent payments made through RentRedi as long as you are a tenant using the RentRedi app. Note: Manual payments are not able to be reported from RentRedi.

How does it work?

After you’ve started reporting rent, RentRedi will share all on-time rent payments through our secure connection with TransUnion. TransUnion uses the information to adjust & update your FICO credit score. Additionally, on-time rent payments will also be reported to Experian.

I already have great credit. Do I need this?

If increasing your credit score by up to 26 points can make a difference in your tier of credit scores, this is a great option for you. You can see the tiers here: https://www.nerdwallet.com/article/finance/credit-score-ranges-and-how-to-improve